Treasury Technology in 2024: Buyer’s Guide

This guide offers Treasury Officers and CFOs an in-depth overview of the sector’s latest technological trends and changing environment, highlighting Cygnetise’s recent market research and experts’ insights from Citi, ABB and ATEL.

Do you still manually manage authorised signatories? Contact us to see how we can help you automate the process and reduce 95% of the time spent on managing authorised signatories with the latest blockchain technology.

Treasury on the verge of change

At the beginning of 2024, the world of treasury is on the verge of significant transformation. Driven by a combination of technological advancements, regulatory shifts, and evolving global economic dynamics, treasury departments worldwide are reimagining their roles, tools, and strategies. The rise of digital currencies, the increasing importance of real-time data analytics, and the growing emphasis on sustainability and ESG (Environmental, Social, and Governance) considerations are just a few of the factors propelling this change.

The digital revolution, which has been reshaping industries across the board, has made a profound impact on treasury functions. Blockchain technology and the rise of cryptocurrencies are challenging traditional banking and transaction systems, offering faster, more transparent, and potentially more secure methods of transferring value. Central banks, including those from major economies, are exploring or have already launched their digital currencies, signalling a potential shift in the very fabric of global financial systems. Additionally, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into treasury management systems is enabling more accurate forecasting, risk assessment, and fraud detection, allowing treasury professionals to make more informed decisions.

However, with these advancements come new challenges and responsibilities. The regulatory landscape is rapidly evolving to keep pace with these technological changes, and treasury departments must remain agile to ensure compliance. Furthermore, as businesses increasingly recognise the importance of ESG factors in their operations, treasuries are under pressure to align their strategies with sustainable and socially responsible practices. This includes everything from ethical investment choices to ensuring that financial operations don't inadvertently support harmful industries.

As the future unfolds, it's clear that the treasury is no longer just about cash management; it's about navigating a complex, ever-changing landscape with foresight and adaptability.

“The treasury’s job is to make sure there is full understanding and accountability for the risks that are being taken. The role of the treasury is not in making the ultimate decision, of course, but in bringing the perspective by identifying the economic costs of doing something … and making sure that those economic costs are understood.”

Challenges treasurers faced in 2023

According to Deloitte's latest Global Corporate Treasury Survey, the aftermath of the COVID-19 pandemic has brought liquidity risk management to the forefront of CFOs' priorities. While external market funding remains accessible, treasurers are increasingly focusing on working-capital improvements, especially given the challenges posed by supply chain disruptions. The shift to remote work in 2021 emphasised the need for enhanced control over both domestic and overseas operations. As a result, many corporations are now gravitating towards treasury centralisation and digitisation. This dynamic landscape has brought a series of challenges for the treasury function. These include:

Building a resilient treasury department

The pandemic underscored the importance of digital capabilities, controls, and business continuity in treasury functions. While many treasury departments showcased resilience by adapting to new work environments and increased digitisation, they weren't immune to the active job markets. Some reported a 25% attrition rate in their treasury teams in 2021/22. This has led to a re-evaluation of team structures, sizes, and required skill sets. The treasurer of tomorrow will need a blend of treasury expertise, data modelling, digital proficiency, and soft skills.

The pandemic also prompted treasury departments to focus intensely on liquidity. While some organisations had robust analytical capabilities as part of their Business Continuity Plans (BCP), none were prepared for an extreme scenario like the pandemic. Now, many are embarking on transformation initiatives to enhance digital capabilities, improve liquidity and financial risk forecasts, and revamp their overall liquidity management frameworks. This includes developing business continuity plans for potential future scenarios.

The increasing reliance on remote working and technology use, while offering efficiency, also opened up new opportunities for cyberattacks, data breaches, and system outages. Staying up-to-date with emerging threats and ensuring and maintaining robust security controls and policies remained top of mind for corporate treasurers in 2023.

Addressing FX risks, volatility and cash visibility issues

Managing FX risks presents its own set of challenges. A significant 83% of Deloitte’s survey respondents cited a lack of visibility of FX exposures and the reliability of forecasts as a primary concern. Other issues include manual exposure identification processes, a lack of understanding by business units, and the ability to analyse exposures and measure hedging results.

Visibility into global operations, cash, and risk exposures was yet another considerable hurdle for most treasury executives in 2023.

Navigating regulation and compliance

More than half of Deloitte’s survey respondents indicated that keeping up with regulation, especially the developments in the Interbank Offered Rates (IBORs) transition and ESG, as a top priority for them in 2023. As organisations navigate the ever-changing regulatory landscape, many are looking to technology (TMS, APIs, automation, and blockchain) to help enable these key priorities.

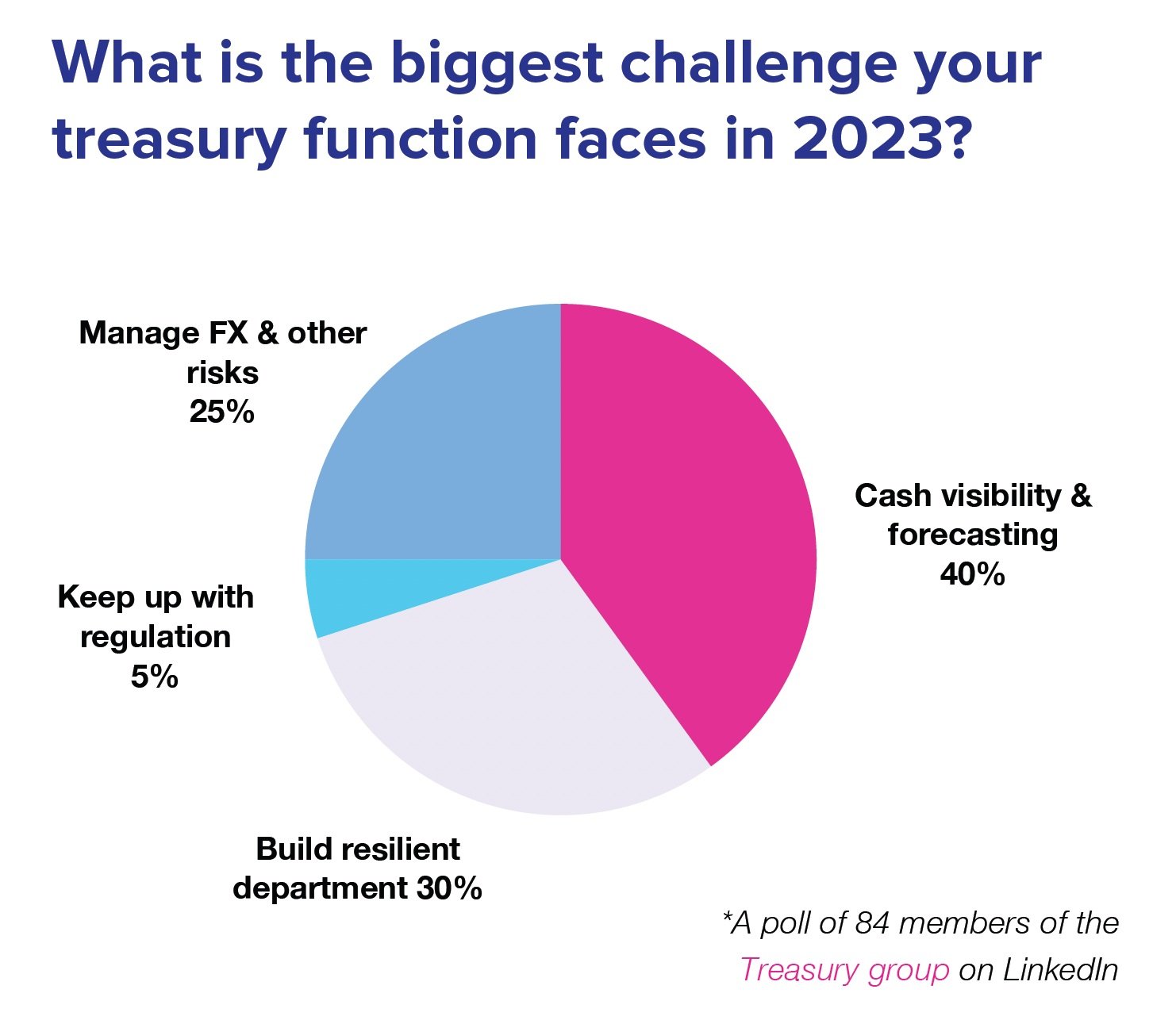

To further assess treasurers’ sentiment, we asked members of the Treasury group on LinkedIn to identify the biggest challenge their departments faced in 2023. Similar to Deloitte's survey results, out of the 84 practitioners who completed the poll, 40% identified “Cash visibility & forecasting” as a major hurdle, while 30% struggled mostly with building a resilient department. 25% of respondents faced key issues managing FX and other risks, and only 5% considered navigating regulations and compliance as a primary challenge.

Kleinwort Hambros Bank reduces 95% of time spent on managing authorised signatories

Treasury technology trends

As noted in the previous section, the treasury landscape is facing a rapid evolution, driven by the need for enhanced liquidity and risk management, and technological adoption. At the beginning of 2023, Adaugeo Media published the results of their latest Treasury Dragons Technology Survey which highlighted 5 key trends shaping the treasury technology market and adoption. We’ve summarised them all in the following section.

1) Consolidation and innovation in the treasury tech market

The treasury technology market has witnessed significant consolidation in the past year. Among the most notable M&A

cases were:

Payments specialist TIS acquiring cash forecasting expert Cashforce

Opus Capita and Analyste merging to form Nomentia which later acquired the Austrian treasury tech provider TIPCO

Coupa's acquisition of Bellin, followed by its own acquisition by private equity firm Thoma Bravo

BNP Paribas acquiring FX specialist Kantox

However, this hasn't stopped many new players from continuing to enter the market, most of which are going after the mid-size segment. Whilst this means more options for treasury practitioners, it also means more extended valuation and decision-making.

In terms of innovations, a few emerging technologies have gained traction in the treasury space, namely:

Application Programming Interface (API)

Robotics & Robotic Process Automation

Visual Analytics

ML & AI

Big Data

Blockchain

According to Deloitte’s latest research, API has so far proved the strongest use case for treasury departments, with 86% of survey participants either adopting or considering adopting the technology in the near future. Other technologies like RPA and Visualization/Analytics have also gained popularity, but they typically span the entire finance function rather than being built exclusively for treasury. About 20% of organisations have also been considering ML/AI, while blockchain is yet to unveil its full potential for treasury due to its limited current application in the sector.

2) Automation and cash forecasting top treasurers' technology wish list

Treasurers had clear priorities for 2023. At the top of the list was greater treasury automation, with 61% of treasurers naming it as a priority, a slight increase from the previous year. Cash forecasting remained crucial, with 55% of respondents emphasising its importance. Interestingly, the focus on cash visibility almost doubled in importance as compared to the previous year.

This was also reflected in treasurers’ desires and expectations from technology providers and solutions in 2023. In addition to better cash forecasting capabilities, practitioners sought:

Seamless connections between banks, treasury systems, and ERPs

Enhanced solutions for reporting, especially interactive reporting

Greater centralisation - a single solution or at least a unified sign-on for multiple systems

Save time and effort whilst enhancing governance

Cygnetise digitises authorised signatory management in a secure, cost-effective and sustainable way.

3) Adoption is on the rise and payments are leading the way

There has been increased automation in almost every area of treasury except risk management, with payments remaining the most automated process. There has also been a notable divide in the automation of treasury management system interfaces to general ledgers, with nearly 30% of treasurers reporting no automation and 20% indicating full automation.

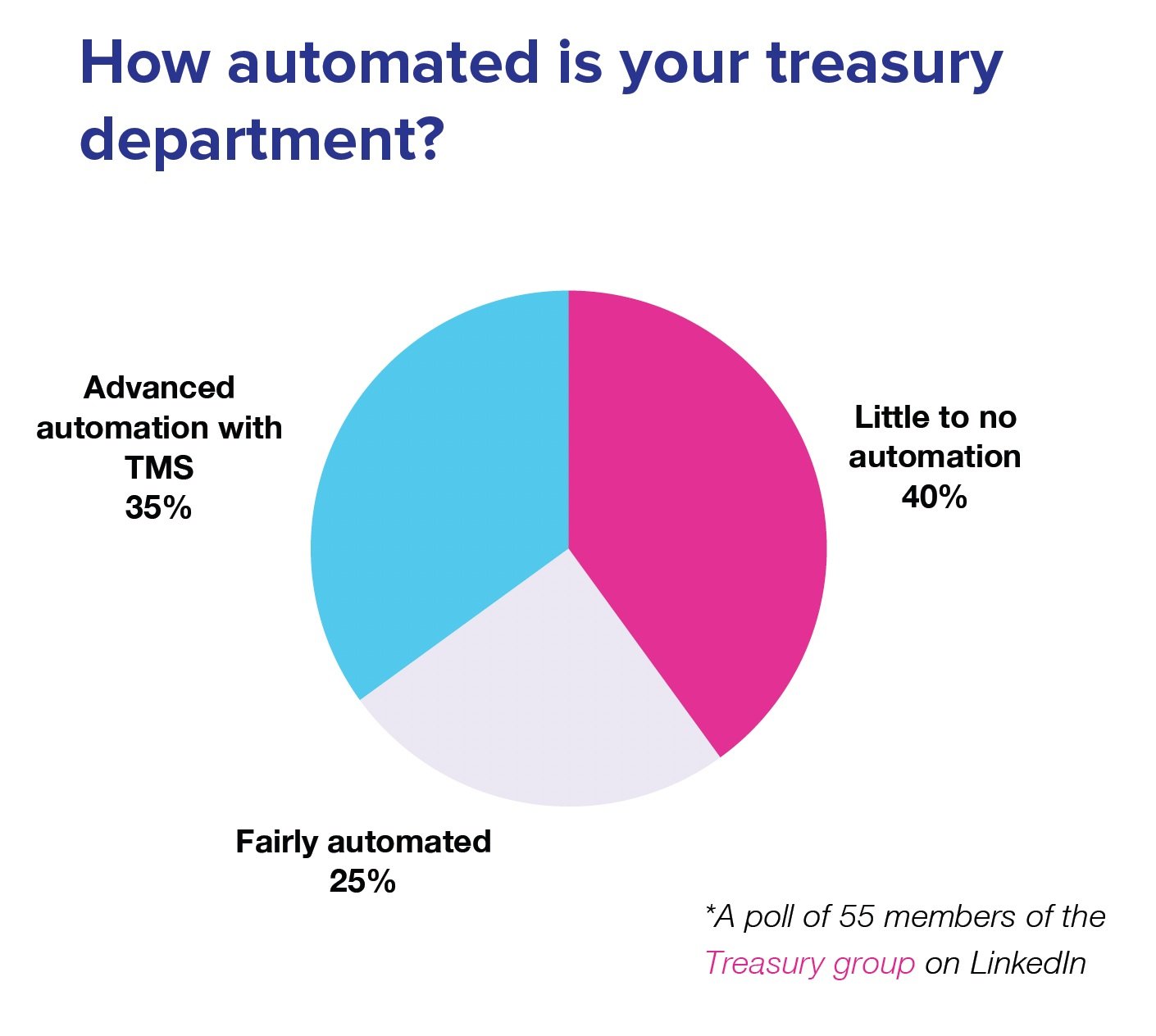

This trend was further pronounced by the results of our own research. According to the results of a poll of 55 members of the Treasury group on LinkedIn in 2023’s Q3, over 40% experienced little to no automation, and only 25% considered their function to be fairly automated. Less than 35% had completely automated their treasury department by implementing TMS software.

Despite the significant advancements in treasury platforms, presenting data in a format suitable for non-treasury audiences is still mostly manual requiring the use of tools like Excel or, occasionally, Power BI or other specialised reporting solutions.

4) Brand wars: SAP, FIS & Kyriba dominate the treasury systems space

When it comes to the specific systems treasurers use, Coupa and FIS lead the pack, followed closely by Nomentia, Kyriba, Fides, and ION. Interestingly, over 40% of treasurers use more than one treasury technology solution, highlighting the need for integrated systems.

In contrast, SAP Treasury was cited as the most used system among the respondents in Deloitte’s 2022 Global Treasury Survey, followed by Kyriba, FIS, and ION depending on the modules.

SAP is leading the way based on our own research too. Out of the 100+ respondents to our survey poll in the Treasury group on LinkedIn at the end of 2023, over 30% identified SAP as their main treasury software provider. More than 25% used Kyriba and less than 20% FIS.

5) The road to treasury technology purchase is rather bumpy

Despite having clear priorities, treasurers face challenges when introducing new technology. In larger organisations, multiple stakeholders need to be consulted, making the process complex. Budgets for treasury technology remained fairly static in 2023, with half of the treasurers planning to spend between $50,000 and $250,000 in the upcoming year, as per Treasury Dragons’ research.

What to look for when selecting a treasury technology: The experts’ advice

According to the UK treasury advisory firm ‘Strategic Treasurer’, having a proper mindset set for the future is the most fundamental prerequisite for a successful technology project. This usually means taking an intentional step back from the pressures of the current situation and any urgent pain points to consider and look at the bigger picture and opportunities. A technology solution shouldn’t be only intended to tackle the most pressing issues of today but also meet an organisation’s plans, goals and anticipated needs of tomorrow.

When selecting a tech vendor and solution, organisations usually go through 3 key adoption phases, including:

Creating a business case - to be effective, a business case should include a reasonable ROI and be strategic in a way that meets the business’s long-term goals and potentially addresses multiple operational problems and pain points across the entire organisation, not only financially. This will allow treasurers to easily gain the buy-in of other key stakeholders or gatekeepers who might present an obstacle.

Evaluating and selecting a vendor and solution - in today’s ever-growing tech market, treasurers might end up with a fairly long list of vendors and solution options depending on their needs. Whilst having multiple choices is advantageous as it allows organisations to better meet their exact requirements, it can often make evaluation and selection a rather lengthy and confusing process. To shorten the list, advisors recommend organisations look for tech providers who “see themselves as strategic partners” and are able to support them and meet their needs in the long term. They also advise doing only very high-level due diligence at the initial stage of the evaluation process and leaving the “proper” due diligence for the final stage of vendor shortlisting and consideration.

Implementation - the final step of the adoption process often takes longer and goes over budget, but organisations can prevent this by taking a realistic approach following a phased and banded timeframe.

Things to consider when undergoing treasury digital transformation: The experts’ advice

Ron Chakravarti | Global Head of Client Advisory, Treasury and Trade solutions at Citi

“Often the biggest challenge [to enabling real-time visibility] is the internal infrastructure and not so much just the system budget, but the resources to start making those changes.”

“What we want to do is to have the business, as it expands and as it grows, adopt the principles that you put in place [so] treasury builds up the infrastructure to support you rather than having treasury constantly running behind, adapting. Adopt rather than adapt.”

“One of the things that treasury teams need to be doing — and we all need to be doing — is to get much more savvy about technology and data.”

“There is a real opportunity for treasury. The value that they were creating became very important when we were in the full flux of COVID-19 — the crisis then, in terms of company cash flow and [the resulting] pivot. Treasurers gained credibility and have a better ability to show why they have a plan, why their plan requires investment in people and technology resources and why those adopted changes are essential.”

“The treasury team and the group treasurer need to be enabled with the budget, the technology and, ultimately, the organisational backing to do some of the changes that sometimes are very hard to do.”

Tobias Schneider | Treasury SAP Business Consultant at ABB

“Many organisations nowadays are at a treasury technology crossroads. Right at the beginning of 2023, the transformative power of Artificial Intelligence (AI) became increasingly apparent. McKinsey has recently estimated the value of generative AI to be between $2 and $4 trillion annually, highlighting its immense economic potential primarily linked to a boost in productivity.”

“The treasury function is not an exception. To adapt to the changing digital economic environment, companies need to develop a strong digital plan for treasury, understand how AI and new technologies will fit into their operations, and identify areas for tech improvements, covering everything from cash handling to risk management, including business and IT aspects.”

“Using visualising tools like process mapping can help organisations easily spot critical inefficiencies and opportunities for automation and optimisation.”

“Collaboration with stakeholders across the entire organisation is vital for the successful implementation of any digital transformation project. Over-customising software, for example, might put too much strain on the IT team and potentially jeopardise the whole process. Setting up a consistent feedback system can further ensure that treasury functions remain in sync with technological trends, guaranteeing agility and adaptability as the digital terrain continues to evolve.”

François Masquelier | Chairman of ATEL and CEO of Simple Treasury

“Treasurers should spend time calculating the qualitative and quantitative benefits of possible investments in the function. Compliance is important, and new incoming financial regulations could be an issue. Additional reporting requirements could create new challenges for the organisation, which may have to change some parameters in the business, the TMS, or the other tools treasurers are using.”

“There is a quest for digitisation and we have placed much hope in new technologies and innovation, not only for cash management but also for fraud management. For treasurers, it’s important to reinforce their threat responses and enhance internal controls. As treasurers have limited resources, it’s also essential to be efficient and to free up time to play a more strategic, analytic, partnering role. Treasurers must automate if they want to focus on value-added tasks.”

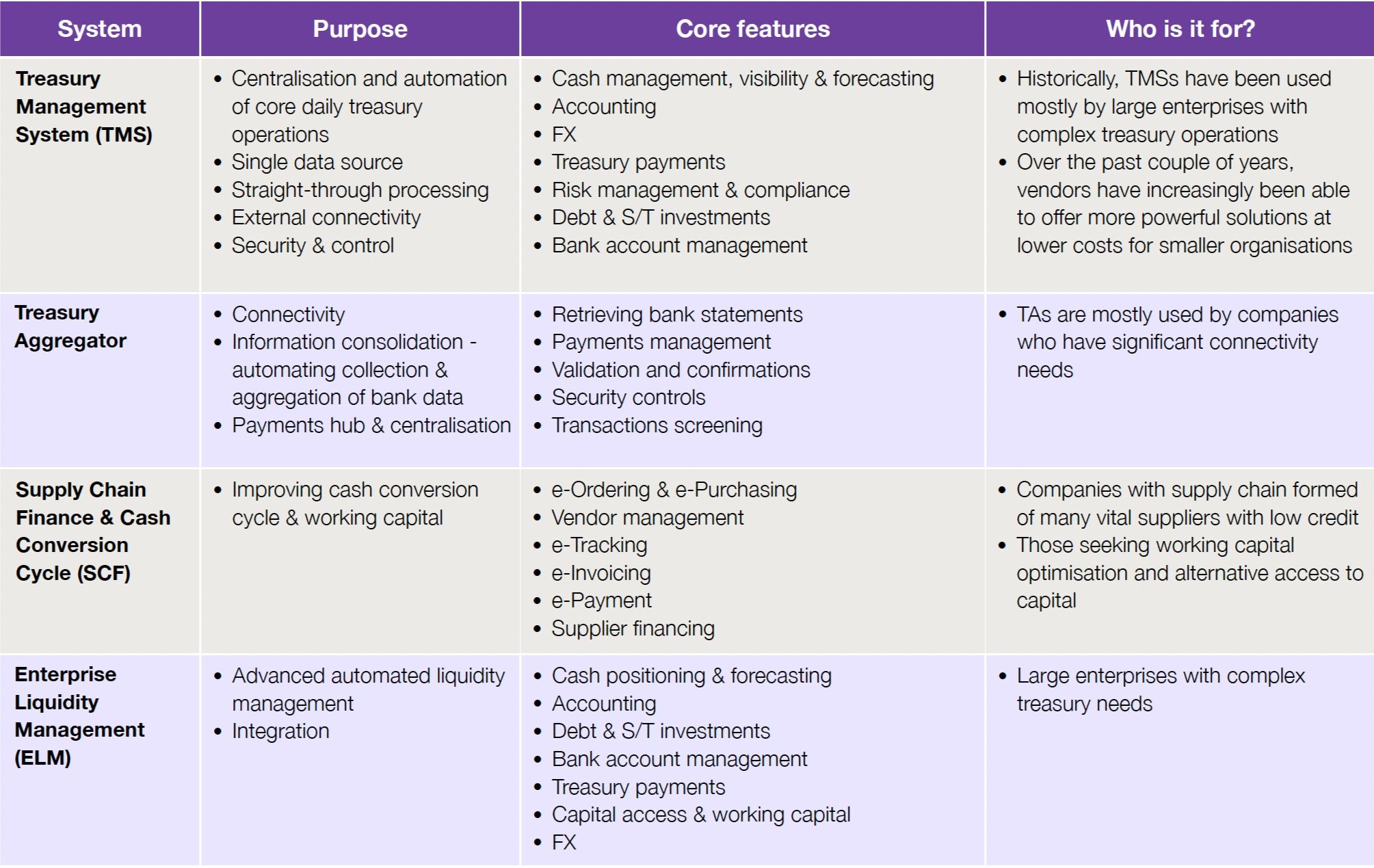

Treasury tech systems overview

Conclusion

In 2023, the treasury landscape went through a significant transformation, driven by technological advancements, regulatory shifts, and global economic dynamics. New technologies like API, ML/AI, and blockchain have considerably enhanced treasury management operations and processes, facilitating better forecasting, risk assessment, and fraud detection. The constantly evolving regulatory environment and a stronger emphasis on ESG factors combined with the increased liquidity and FX risks due to the COVID-19 pandemic have also been pressing treasuries towards building a more centralised, digitised, resilient and sustainable function.

Despite the rising digitalisation trend in the sector, treasury remains one of the least automated and digitised corporate functions in contrast to other core departments, with over 40% of organisations having implemented little to no treasury automation. The main reason for this slow adoption rate is that implementing new treasury technologies tends to be an extremely costly and lengthy process due to the involvement of multiple stakeholders and generally static budgets in most organisations. In terms of areas of digitalisation, payments are the most automated treasury process, whilst brands like SAP, FIS & Kyriba are dominating the TMS space.

When selecting treasury technology, treasurers should focus on the following 5 key factors:

assessing their current situation,

identifying key pain points and relevant tools features,

evaluating pricing vs. quality,

focusing on onboarding and integration, and

managing supplier relationships effectively.

In conclusion, 2023 proved to be pivotal for many treasury departments worldwide. The rapid technological advancements, coupled with the changing global landscape, necessitate a proactive and informed approach to treasury management. Adopting the right technology and staying abreast of trends is thus essential for modern Treasury Officers and CFOs to remain competitive and thrive.

Treasury Technology in 2024: Complete Guide

Download the complete PDF version of this guide with our comprehensive comparison of the most popular treasury technology solutions and providers on the market.