Managing authorised signers and bank mandates manually is time-consuming, error-prone, and risky.

Cygnetise empowers corporate treasury teams to digitise this process, reducing fraud risk, accelerating transactions, and improving operational efficiency across the board. It also facilitates regulatory reporting production, including FBAR.

Why use Cygnetise

Minimise fraud risk

Replace spreadsheets, PDFs, and fragmented records with a secure, centralised system. Cygnetise reduces exposure to fraud and manual errors by providing a single source of truth for signatory data, kept accurate in real time as personnel change.

Accelerate transactions

Update signatory lists and bank mandates in just a few clicks. Real-time sharing with internal teams, banks, and counterparties eliminates delays and ensures everyone is working from the latest data.

Audit-ready and compliant

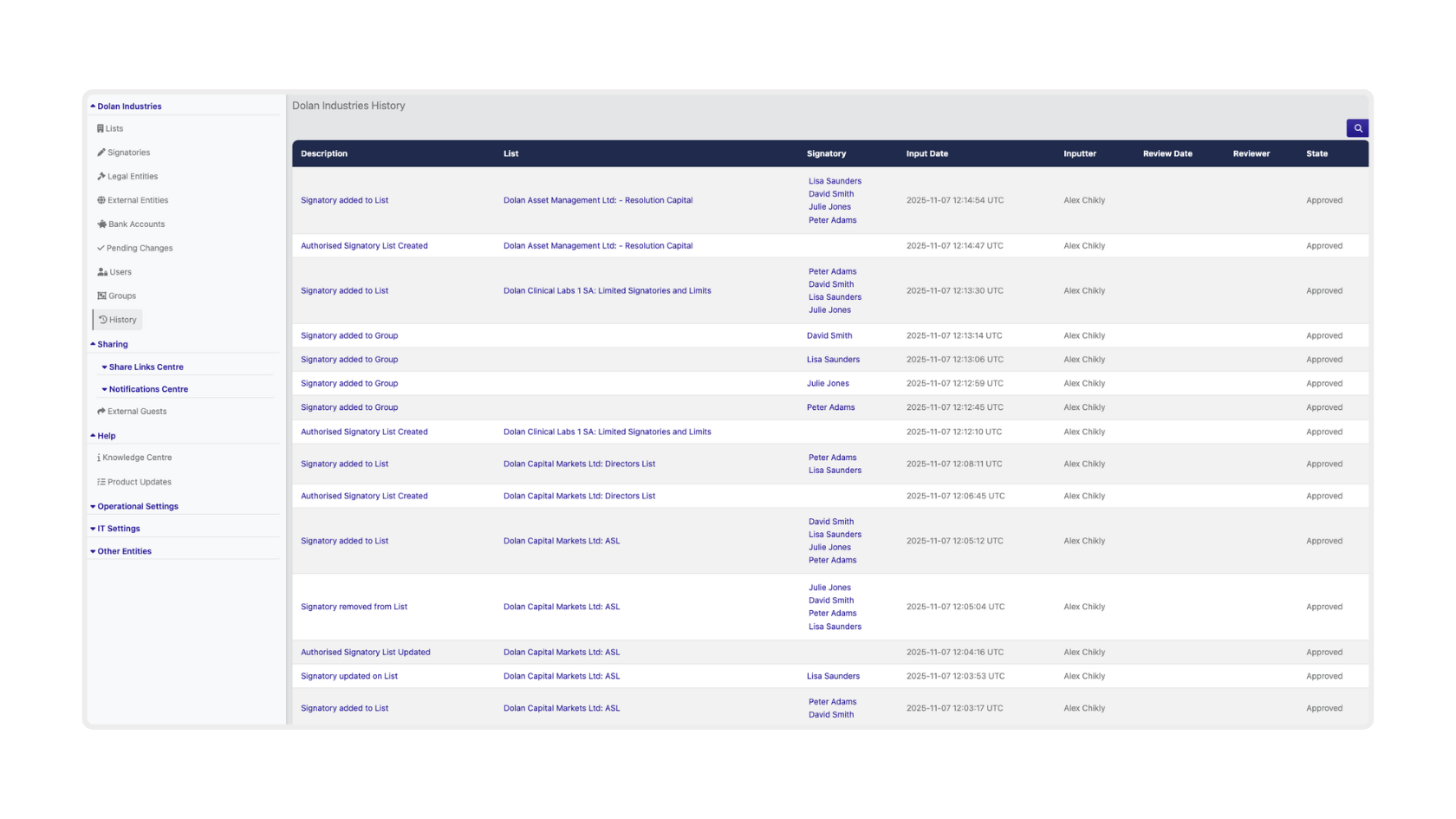

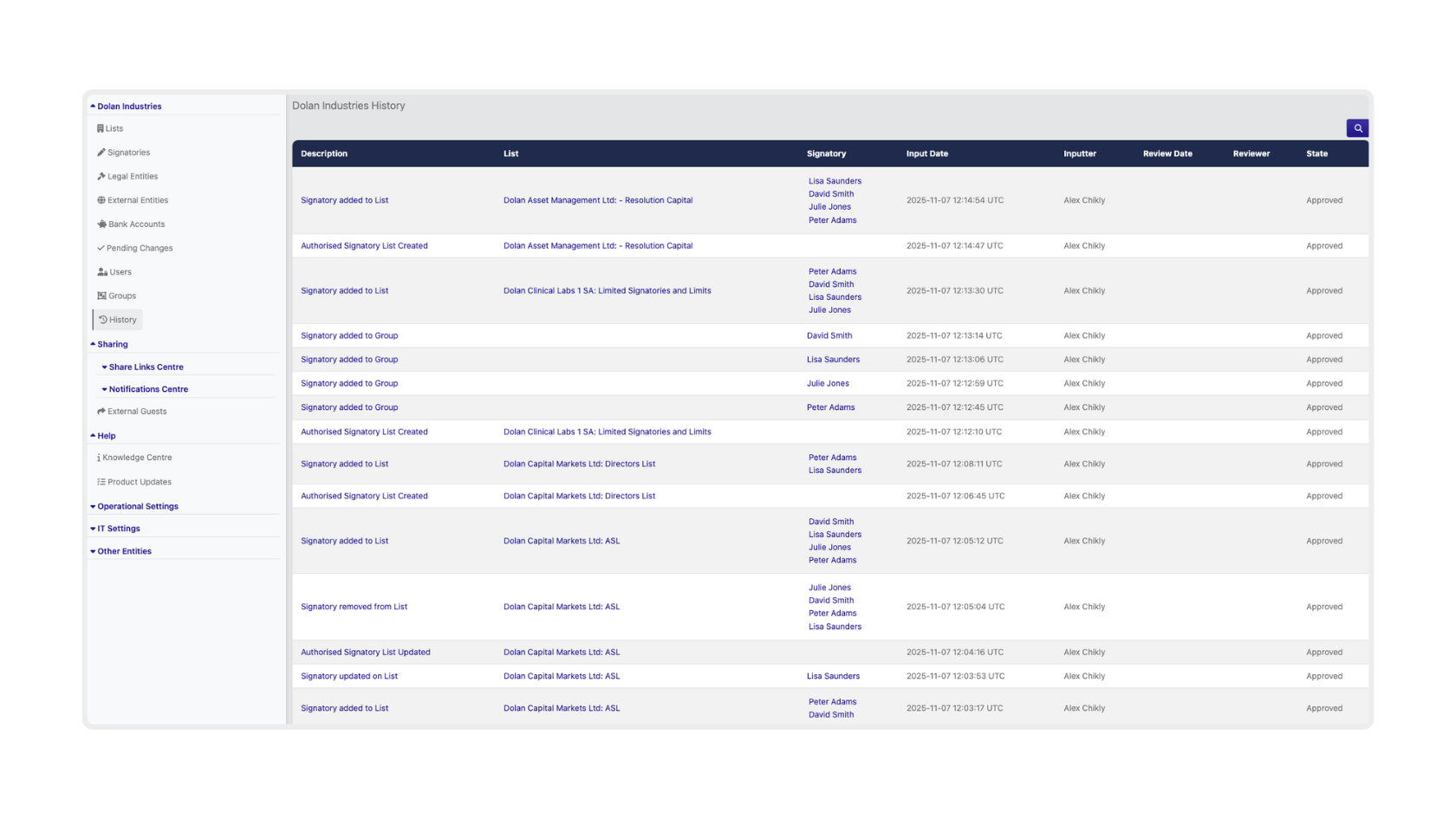

Every update is automatically logged with a full, immutable audit trail, making it easy to meet compliance standards and confidently prepare for audits.

“The banking team are now able to update signatory lists in a secure environment in a matter of minutes, reducing administrative burden and increasing operational efficiency.”

Key functionalities

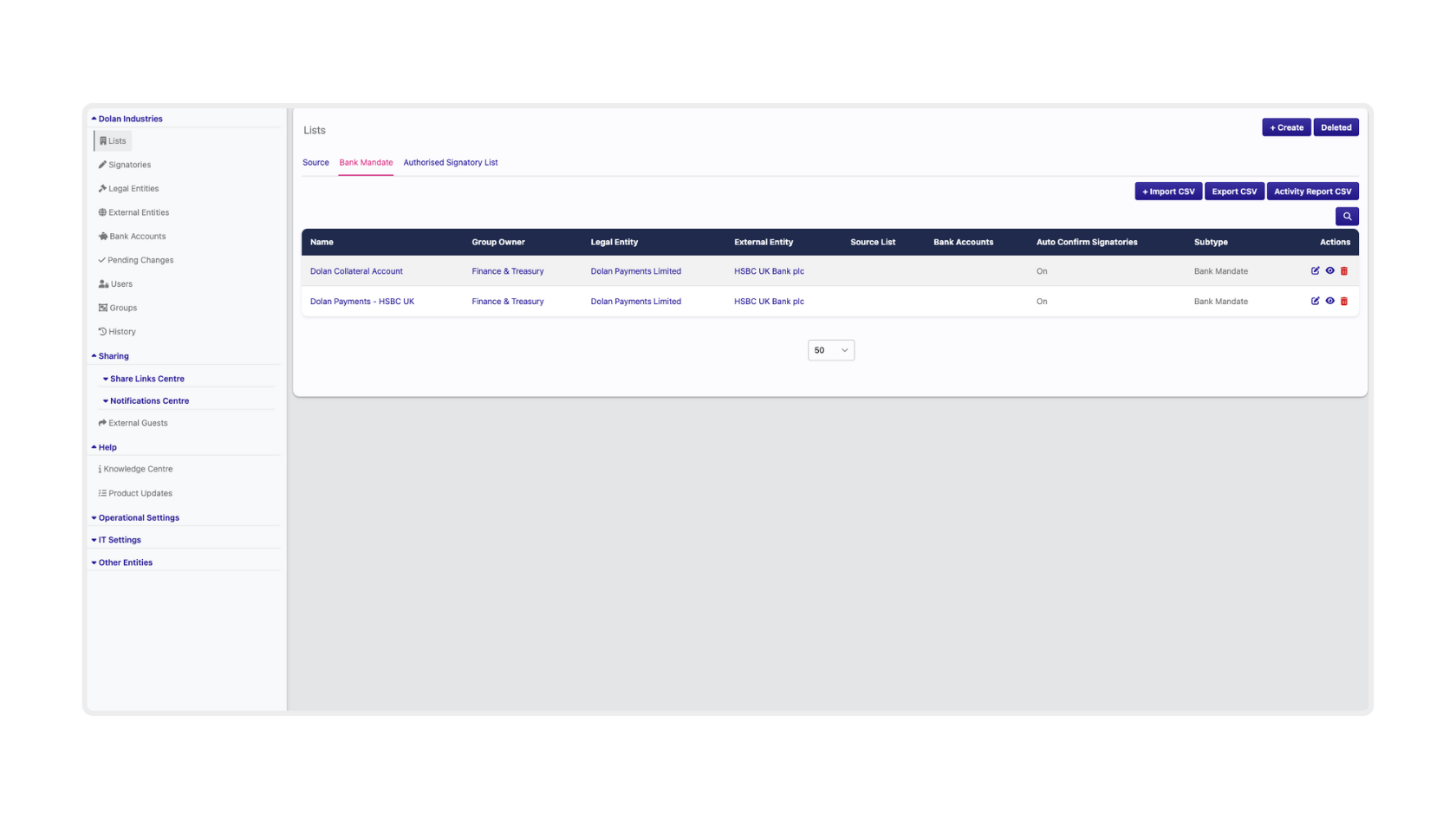

✔️ Fit-for-purpose centralised database management: Digitise and centralise all signatory and mandate data, and maintain complete oversight of all signing authorities across entities

✔️ Diverse and secure e-sharing for banks: Securely share updates with banks and third parties via various electronic methods, with real-time notifications

✔️ Simple internal publishing: Easily publish and update lists of authorised signatories to internal areas

✔️ Robust audit trail: Maintain an unalterable historical record of all changes made for compliance and transparency

“Cygnetise allowed us to easily create and maintain signatory lists, and have a simple overview of any individual’s signing authorities across different business lines and entities.”