Contract management in 2025: Modernising who signs, how and why

Contracts are the infrastructure of modern commerce. They memorialise promises and underpin everything from basic supply agreements to high‑value corporate transactions. The fundamentals of contract law (incl. offer, acceptance, consideration and the intention to create legal relations) are timeless. Yet, the way contracts are executed and the people authorised to sign them have changed dramatically since the last time we looked at the issue in our original blog from 2021 here.

Why signatory authority matters

A contract signatory is anyone who signs a contract and therefore becomes bound by its terms. An authorised signatory is a person formally empowered by an organisation to sign on its behalf. All authorised signatories are contract signatories, but not all contract signatories have the authority to bind the organisation. Signing without authority can render the agreement unenforceable or expose the organisation to apparent‑authority claims.

The move towards digital processes and international trade has highlighted the importance of clearly identifying who can sign what. Authorised signatories play a critical role in:

Valid execution. Many jurisdictions require certain documents to be signed by specific officers or a combination of directors and witnesses. Under UK law, for example, deeds often need two directors or one director plus a company secretary; simple contracts may be signed by a single authorised person.

Risk management. Granting signatory authority ensures that only trusted individuals can bind the business, reducing fraud and unauthorised commitments.

Operational efficiency. A defined signatory process helps avoid delays and enables deals to close quickly. Using electronic signature platforms and signatory management applications like Cygnetise, for example, allows businesses to designate signatories, send automatic reminders and track execution in an efficient, secure and centralised way.

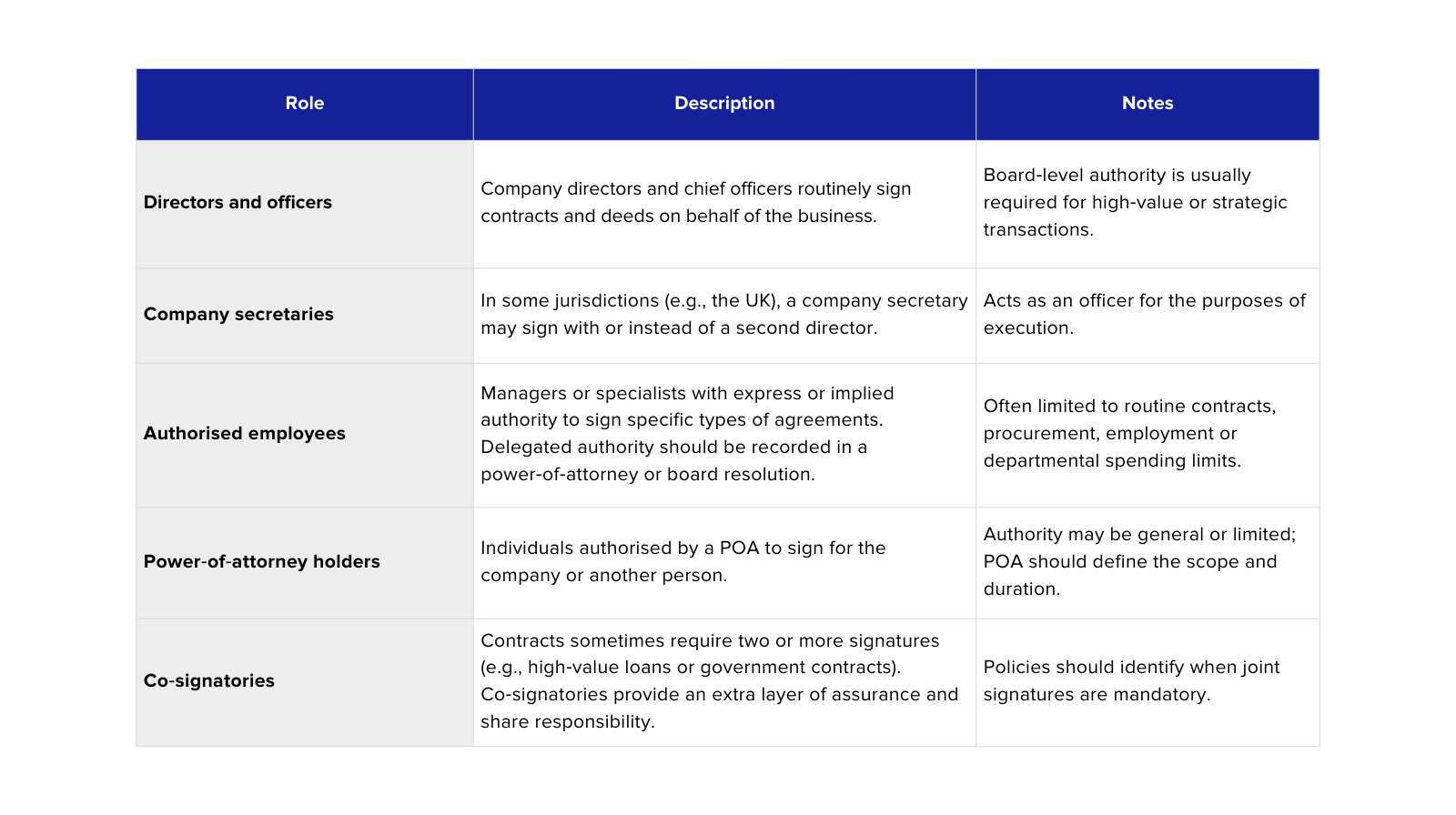

Who can sign? Typical authorised signatories in 2025

Across jurisdictions, there is no single definition of who may sign, but common categories include:

How to establish and manage authorised signatories

Define the delegation of authority. Identify which roles can bind the company for different types of transactions (e.g., sales, procurement, financial). With Cygnetise, organisations can centrally manage authorised signatories in real time, ensuring that responsibilities are clearly defined, changes are applied instantly across entities, and all stakeholders have confidence that the information is accurate and compliant.

Document the authority. Use formal documents, such as signature-authorisation forms, powers of attorney, or board resolutions, to evidence signing powers. Cygnetise allows these documents to be securely attached to each record, kept current, and instantly accessible to both internal teams and external parties such as banks or auditors.

Implement workflows. Cygnetise streamlines signatory management by enabling structured approval processes, controlled updates, and automated reminders. Every change is logged in a complete audit trail, strengthening governance and reducing operational risk.

Train and monitor. Educate signatories on their responsibilities. They must read and understand every clause before signing and verify its accuracy. Ongoing monitoring helps detect unauthorised changes and ensures compliance.

Audit and update regularly. With Cygnetise, organisations maintain a live, centralised list of signatories and receive automated reminders to review records. This prevents outdated authority being misused and ensures signatory data remains reliable and audit-ready.

Consequences of unauthorised signing

If someone signs without proper authority, the contract could be void or unenforceable; in some cases, the company may still be bound because of apparent authority (where the counterparty reasonably believed the signer had authority) or ratification (the board later approves the contract). Breaches of signatory rules can lead to financial loss, legal action and reputational damage.

Digital signatures and e‑ID for 2025

The pandemic accelerated the adoption of electronic signatures. Today, most jurisdictions treat electronic signatures as legally valid, provided they meet statutory requirements. Key developments for 2025 include:

EU eIDAS 2.0 and the European Digital Identity Wallet. The updated eIDAS framework came into force on 20 May 2024 and is being rolled out in stages. It introduces a European Digital Identity (EUDI) Wallet that will allow EU citizens and businesses to carry a digital identity and generate qualified electronic signatures (QES) across borders. QES signatures have the same legal effect as handwritten signatures and must be created using trusted service providers. Implementation guidelines envisage widespread availability of digital identity wallets by 2026.

UK and common‑law jurisdictions. Electronic signatures have been legally recognised since the Electronic Communications Act 2000. Witnesses may be required for deeds, which means signatories and witnesses must sign in each other’s presence (physically or via secure video). In April 2024, the UK government consulted on adopting the eIDAS 2.0 framework; businesses should monitor further developments.

USA. The ESIGN Act (2000) and the Uniform Electronic Transactions Act (UETA) grant electronic signatures the same legal status as handwritten ones. For a digital signature to be valid, there must be intent to sign, consent to do business electronically, a clear option to opt out, delivery of a signed copy and proper record retention.

Types of electronic signatures. Under eIDAS, there are standard, advanced and qualified e‑signatures. Advanced and qualified signatures require the signer’s identity to be uniquely linked and verified. Qualified signatures are created using secure signature‑creation devices and provide the strongest legal evidence.

Security and data protection. GDPR applies to personal data collected during signing. Businesses must ensure they have a legal basis for processing signature data, use secure authentication methods, inform signatories about data handling and keep data accurate.

Best practices for contract signatories in 2025

Understand the contract. Signatories should read the entire contract, check dates and obligations, and consult legal counsel where necessary.

Verify authority and capacity. Always confirm that you (and any co‑signers) have the authority to bind the organisation. Check if the contract requires multiple signatures or witness signatures.

Check identity and authentication. For electronic signatures, use platforms that capture the signer’s identity (e.g., email, IP address, digital certificates) and provide an audit trail. When using qualified signatures under eIDAS 2.0, ensure the service provider is accredited.

Maintain records. Store signed contracts securely and track key dates such as renewals, obligations and termination clauses.

Stay compliant with local laws. Identify whether a contract is a simple contract, a deed or requires special formality. In some countries, certain documents (wills, property transactions) still require wet‑ink signatures.

Effective contract management in 2025 requires more than understanding basic legal elements; it demands a robust signatory governance framework. Organisations should maintain up‑to‑date lists of authorised signers, define clear approval hierarchies and use digital tools to automate execution. As jurisdictions adopt eIDAS 2.0 and digital identity wallets, electronic signatures will become the default way to execute agreements. By following best practices and staying current with legal developments, businesses can protect themselves from the risks of unauthorised signing and streamline the contract lifecycle.