Types of authorized signatories

A quick guide to ‘authorized signatory’. What it means and what are the most common types of authorized signatories or signers.

What is an authorized signatory?

Simply put, an authorized signatory or signer is a person who’s been given the right to sign documents on behalf of the authorizing organization. However, the term’s meaning and interpretation seem to vary significantly across different jurisdictions and industries. So, in today’s blog, we’ve put together an overview of some of the most common uses of the term.

An authorized signatory assumes the rights and responsibilities outlined in any agreement they sign. This title is not limited to individuals but can also be applied to organizations or even countries. For example, in international treaties, a signatory country agrees to the terms and conditions set forth in the treaty.

Historical context

Historically, the term signatory was used to describe countries that have signed a convention or a treaty. This usage has since broadened, and today, the term can be used to describe any person, organization, or country invited to sign an agreement. This evolution in terminology highlights the increasing complexity and interconnectivity of legal agreements in our modern world.

Modern usage

In modern contexts, being an authorized signatory involves more than just the act of signing. It often includes the responsibility to ensure that the document's terms are adhered to and that the organization they represent complies with the agreement. This role is crucial in various sectors such as finance, law, and business, where the validity of a document hinges on the authorization of the signatory.

Understanding the role and significance of an authorized signatory can help clarify the responsibilities and expectations associated with this title, whether in a corporate, governmental, or international setting.

Common types of authorized signatories

Company signature authorization

Designated officers/employees within an organisation who are authorized to process and approve official documents and third-party agreements on behalf of the organisation are often referred to as “authorized signers”.

The process of signature authorization usually forms part of a broader “Delegation of Authority Policy” that establishes an internal procedure for appointing approval and signing authority, and defining the level of scope of that authority. The policy also includes a list of general responsibilities for authorized signers to follow when reviewing, approving and processing company contracts and official documentation.

For example, many organisations restrict signature authorization to directors or senior employees and set contract value limits applying at different seniority levels. Typical signatory duties include:

Dealing with resolutions

Signing and delivering official documents and agreements with third parties and serving as a company’s agent

Signing/authorizing goods/product orders

Signing/authorizing permits, passes or time-sheets

Giving any notices

Executing any specific undertakings and approvals

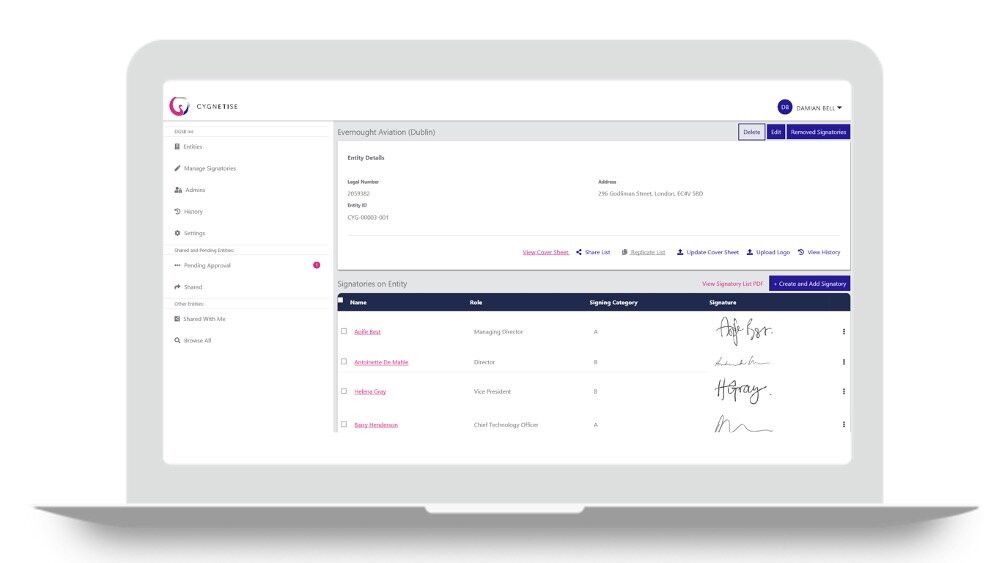

The golden source signatory repository

Reduce the risk of contract disputes and signatory fraud, complement e-signature protocols and facilitate business continuity with Cygnetise’s Signatory Management Platform.

Authorized signers on bank accounts

In banking, personal and business account holders can authorize someone else to manage their account. These people are also usually called authorized signatories. Many banks require account holders to be recognised as authorized signatories, too.

In terms of level of authority, authorized signers usually have the same access to the bank account as the account holder.

In business banking, however, the rights of authorized signers tend to differ across various jurisdictions and depend on local government’s specific legislations. Some of the most common types of permissions held by authorized signers on business accounts are:

Ability to sign checks/cheques

Access to an account’s balance

Access to transactions history

Ability to cancel payments on checks/cheques

Ability to close the account

In the US, there’re also specific rules for authorized signers on business accounts owned by limited liability companies (LLCs). Although an authorized signer is allowed to do business in the same way as the owner of the bank account (the LLC), he/she doesn’t have the same legal responsibilities as account holders. This requires a highly trusted individual to be designated as the second authorized signer on an LLC business bank account. Legally, an authorized signer is permitted to make financial transactions from the account such as spending or approving company funds.

Signature authority can be given by an LLC to one or more individuals for all legal and financial documents or rights can be approved for only certain accounts or transactions. Moreover, sometimes different roles have the permission to sign off on specific paperwork. For example, a managing director or LLC president may be the authorized signer for the following documentation:

Loan documents

Partnership agreements

Contracts

Whereas, the CEO of the LLC may have the authority to sign off on other documents, such as:

Loans

Checks/cheques

Any other finance-related paperwork

In personal banking, individual authorized signatories can usually use an account separately if the mandate says “several”, “any” or “either” authorized signatory can sign (that is, operate the account).

Otherwise, if a mandate requires “joint”, “both” or “all” (or in some cases “any two”) authorized signatories to sign or access the account together, it means that one authorized signatory alone cannot use the account. Other authorized signatories must also authorize the transactions. A bank cannot allow transactions or other activity without the consent of the other holders.

Trading authorization on investment accounts

In brokerage, authorized traders refer to brokers or agents who are permitted to trade on behalf of the investor/client. In other words, trading authorization allows an investor to grant a certain level of authority to a third party for the purpose of trading on a designated trading account. This usually happens when an individual person decides to appoint a financial professional to receive financial advice.

Generally, there’re two types of trading authorization levels: full trading authorization and limited trading authorization. To establish the level of trading authorization, the primary account holder is usually required to consent to the authorization through an official formal document or contract.

The role of a signatory in the digital contracting process

The role of a signatory is key in the digital contracting process, ensuring that deals are officially finalized and recorded. Their signature confirms agreement to the terms, making the contract legally binding and enabling the business to capture revenue accurately.

Key Responsibilities:

Finalizing Agreements: Signatories solidify commitments by signing off on digital contracts, which is crucial for closing deals and driving business growth.

Removing Bottlenecks: By promptly signing contracts, they help eliminate delays that could hinder business operations and project timelines.

Mitigating Risks: A timely and efficient signing process helps in avoiding missed opportunities and minimizing potential losses due to unsigned agreements.

In the digital age, contract lifecycle management systems like DocuSign and Adobe Sign are often employed to streamline the signing process. These tools ensure that signatories can easily and promptly complete their part, which is critical for maintaining smooth business operations.

Additionally, tools like Cygnetise provide enhanced control over the management of authorized signatories. By digitizing the process of managing signatory lists, Cygnetise not only reduces administrative burdens but also ensures that the right individuals are always empowered to sign on behalf of the company. This adds another layer of efficiency, improving governance and reducing the risk of unauthorized or outdated signatories delaying or compromising contract finalization.

Without effective management, signatories might delay or even refuse to sign, which can lead to stalled projects and lost business. Thus, integrating automated solutions not only simplifies the process but also encourages timely sign-offs, supporting the overall business strategy and growth targets.

Who can be a signatory?

Technically, anyone who can legally sign a contract is capable of being a signatory. This means that everyone is entitled to sign a contract unless there is an exception that says otherwise. If an exception does exist, that individual will be incapable of acting as a signatory.

For example, certain types of business contracts will only be capable of being signed by someone with the appropriate signatory authority. Similarly, individuals under the age of 18 can’t enter a contract in certain jurisdictions, so they may not be able to act as a signatory to agreements, or someone might need to act as a signatory on their behalf.

Similar rules also apply to those defined as having a mental disability, having been declared bankrupt, or being intoxicated, so it is worthwhile checking who can and can’t be a signatory to your contracts.